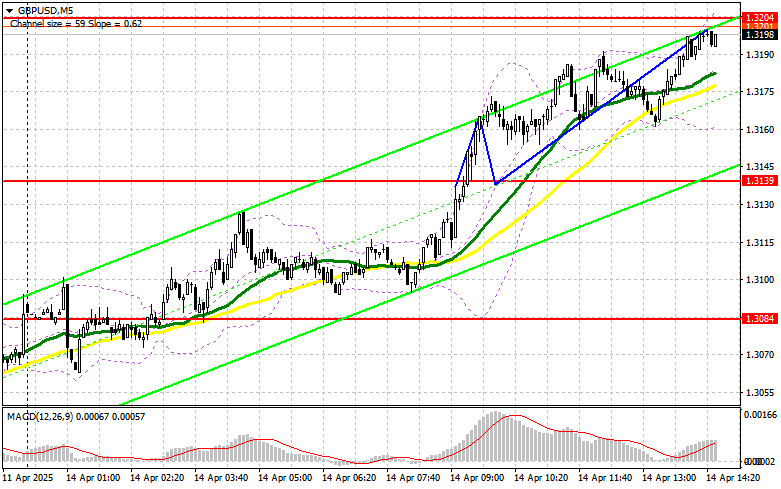

In my morning forecast, I highlighted the level of 1.3139 and planned to make trading decisions based on it. Let's look at the 5-minute chart and see what happened. The breakout of 1.3139 occurred, but the price never returned for a retest, so I stayed out of the market. The technical picture hasn't changed for the second half of the day, and I'm still relying on the same levels.

To open long positions on GBP/USD:

Today's speeches by FOMC members Thomas Barkin and Christopher Waller will be key events for the currency market. Their remarks will be closely watched, as policymakers might indicate a more dovish stance at the next meeting—which would further weaken the dollar and spark new buying of the pound. On the other hand, if their tone is unexpectedly hawkish, pressure on the pair could return. Their speeches will also provide insight into the state of the U.S. economy and the Fed's future plans, which will certainly affect exchange rate volatility.

Given the bullish trend for the pound, it's best to act on pullbacks. A false breakout near the 1.3139 support area would be a good entry point for long positions with a target at 1.3204—a level that almost got hit earlier today. A breakout with a retest from top to bottom of that range would offer a new buying opportunity, aiming for a test of 1.3262, further strengthening the bullish trend. The furthest target will be 1.3301, where I will take profit.

If GBP/USD declines and there is no buyer activity at 1.3139 in the second half of the day, pressure on the pair will return. In that case, only a false breakout around 1.3084 will justify opening long positions. I plan to buy GBP/USD on a rebound from 1.3032, targeting a 30–35 point intraday correction.

To open short positions on GBP/USD:

Sellers didn't even attempt to show themselves, so there was no real reason for the pound to fall in the first half of the day. If GBP/USD rises again during the U.S. session following Fed commentary, a false breakout near 1.3204 will serve as an entry point for short positions, targeting a decline toward new support at 1.3139. A breakout and retest of this range from below would trigger stop-losses and open the way toward 1.3084, where the moving averages are located and currently favor the bulls. The furthest target will be 1.3032, where I plan to take profit.

If demand for the pound remains strong in the second half of the day, which is more likely, and bears fail to appear around 1.3204, then it's better to postpone shorts until testing the 1.3262 resistance. I will sell there only after a failed consolidation. If no downward move occurs there either, I'll look to short from 1.3301, aiming for a 30–35 point downward correction.

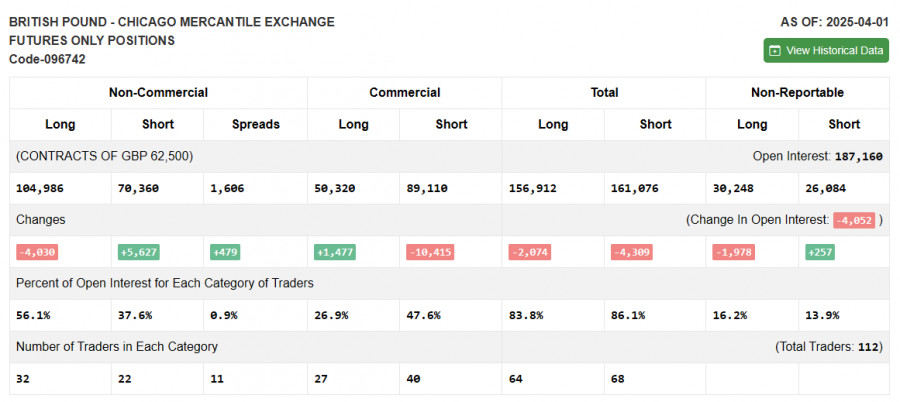

COT Report (Commitment of Traders) – April 1:

The latest COT report showed a slight increase in short positions and a reduction in longs. It's important to note that this report does not reflect recent U.S. tariffs against key trade partners, including the UK, nor does it include the latest U.S. March employment data. Therefore, analyzing the position dynamics in detail is not advisable, as they don't accurately reflect current market conditions.

According to the report, long non-commercial positions fell by 4,030, to 104,986 and short non-commercial positions rose by 5,627, to 64,733. As a result, the gap between long and short positions widened by 479.

Indicator Signals:

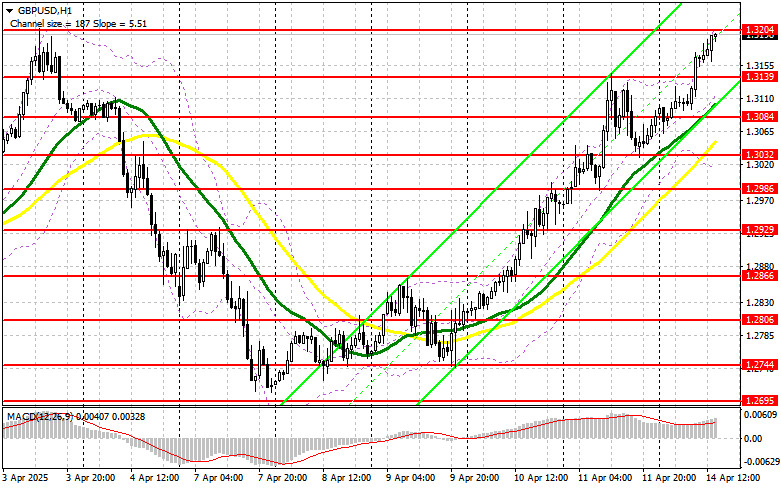

Moving Averages: Trading is taking place above the 30- and 50-day moving averages, which indicates the pair remains in an upward trend.

Note: The author considers the moving average periods and prices on the H1 chart, which may differ from the classic daily MA settings on the D1 chart.

Bollinger Bands: If the pair declines, the lower boundary of the indicator near 1.3032 will act as support.

Indicator Descriptions:

- Moving Average (MA): Identifies the current trend by smoothing out volatility and noise.

- 50-period MA is marked in yellow

- 30-period MA is marked in green

- MACD (Moving Average Convergence/Divergence):

- Fast EMA – 12

- Slow EMA – 26

- Signal Line SMA – 9

- Bollinger Bands: Period – 20

- Non-commercial traders: Speculators such as retail traders, hedge funds, and large institutions who use the futures market for speculative purposes.

- Long non-commercial positions: Total long open positions held by non-commercial traders.

- Short non-commercial positions: Total short open positions held by non-commercial traders.

- Net non-commercial position: The difference between long and short positions held by non-commercial traders.