Procter & Gamble and PepsiCo fell after cutting forecasts, while Hasbro and ServiceNow jumped following their earnings reports. March durable goods orders surged more than expected. Alphabet beat revenue expectations, with shares rising after the market closed. Asian markets are climbing on hopes of a softer US stance toward China. Technology stocks are leading the gains, and the Nikkei is recovering losses. Indices closed higher: Dow up 1.23%, S&P 500 up 2.03%, and Nasdaq up 2.74%.

Tech stocks at forefront: Wall Street extends winning streak to three days

US stock markets finished Thursday with strong gains, marking a three-day winning streak. The main driver was the technology sector, as investors weighed mixed corporate earnings and anticipated possible easing of trade tensions between the US and China.

"Magnificent Seven" sets tone again

All three major US indices showed significant strength, with the Nasdaq standing out thanks to gains from the so-called "Magnificent Seven" that includes tech giants driving AI innovation. ServiceNow (NOW.N) gave an additional boost after its quarterly report beat analyst estimates.

Hope for breakthrough: Beijing and Washington seek compromise

Investor optimism increased after Treasury Secretary Scott Bessent hinted at a possible easing of tariff policies toward China. In response, Beijing called for the removal of US tariffs on Chinese goods, raising hopes for de-escalation of the prolonged trade conflict that has been weighing on markets.

Paul Nolte: chips back in spotlight

Paul Nolte, a senior wealth advisor and strategist at Murphy & Sylvest, observed that growth in the technology sector, especially among chipmakers, was being driven by their prominent role in US-China trade disputes. According to him, any softening in trade tensions acts as a catalyst for tech sector growth.

Trade war's impact: uncertainty intensifies

As the earnings season picks up, it is increasingly clear that ongoing tariff uncertainty is weighing heavily on both business activity and consumer sentiment.

Major companies adjust expectations

Despite the market's optimism, some large US corporations are revising their forecasts. Procter & Gamble (PG.N), PepsiCo (PEP.O), Chipotle Mexican Grill (CMG.N), and American Airlines (AAL.O) have changed or withdrawn their guidance, citing mounting consumer uncertainty.

PepsiCo and P&G under pressure

Shares of consumer sector giants responded negatively. Procter & Gamble dropped 3.7%, while PepsiCo lost 4.9%, reflecting growing concerns about slowing consumer spending.

ServiceNow sets records amid AI boom

Meanwhile, ServiceNow (NOW.N) delivered impressive results, beating analyst expectations on strong AI-driven demand. Shares soared 15.5%, making it one of the day's top performers.

Hasbro surprises market

Hasbro (HAS.O) also impressed investors: strong game segment sales helped beat Wall Street expectations, sending shares up 14.6%.

Over 70% of companies beat expectations

LSEG reports that 74% of the 157 S&P 500 companies that have released their results so far have exceeded earnings expectations. The expected annual earnings growth for the entire index is now seen at 8.9%, up from 8.0% at the start of the month.

Economy shows resilience

New orders for durable goods exceeded expectations, and jobless claims data remains steady, painting a picture of an economy holding up well despite global challenges.

Indices soar

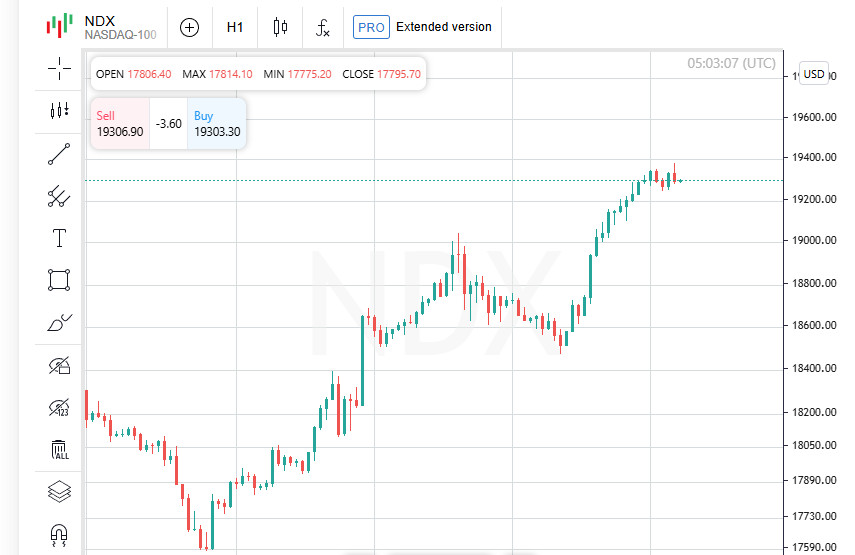

On the back of the positive news, key US stock indices posted solid gains: the Dow Jones added 486.83 points (+1.23%) to close at 40,093.40; the S&P 500 climbed 108.91 points (+2.03%) to 5,484.77; and the Nasdaq Composite surged 457.99 points (+2.74%) to 17,166.04.

Alphabet sets the pace: explosive post-earnings rally

Tech giant Alphabet (GOOGL.O), owner of Google, topped analysts' earnings forecasts and reaffirmed its ambitious AI investment plans. This news sent shares up nearly 5% in after-hours trading and boosted momentum not just among tech peers, but also in S&P 500 futures, which rose 0.5%.

Technology leads Wall Street gains

Of the 11 major S&P 500 sector indices, nearly all finished higher, with the exception of consumer staples (.SPLRCS). The technology sector (.SPLRCT) posted the biggest gain, jumping 3.5% and underscoring investors' growing appetite for high-tech companies.

Market in rally mode: gains dominate

On the New York Stock Exchange, advancing stocks outnumbered decliners by nearly six to one, a ratio of 5.84 to 1. Fifty stocks hit new 52-week highs, compared to 30 new lows, signaling strong positive sentiment.

Bulls also took charge on the Nasdaq, where 3,401 stocks rose and 1,005 fell, resulting in an advance/decline ratio of 3.38 to 1. However, the tally of new highs and lows was more mixed: 40 new peaks against 51 new troughs.

Trading volumes below average

Despite the active price movements, the total trading volume was below average. Around 14.95 billion shares changed hands on US exchanges on Thursday, compared with a 20-day moving average of 19.15 billion shares.

Asia rides optimism wave

Against the backdrop of softer rhetoric between the United States and China, Asian equity markets also posted solid gains on Friday, looking to notch a second straight week of positive returns. Meanwhile, the dollar recorded its first weekly gain in over a month, reflecting a modest rebound in global investor confidence, even in the absence of concrete agreements between the world's two largest economies.

USD searches for support after turbulent weeks

The US currency, which has weathered several weeks of instability driven by trade headlines, is finally showing signs of stabilization. On Friday, the dollar held steady around $1.1350 per euro and 143 yen, while selling pressure on the greenback eased somewhat in Asian markets.

Trade war alters script

After an extended period of tit-for-tat tariffs that effectively paralyzed goods flows between the US and China, Washington shifted its rhetoric this week, signaling a more flexible approach. However, Beijing tempered any enthusiasm, emphasizing that no official negotiations had taken place despite statements from President Donald Trump. In addition, China warned other countries against striking deals that would disadvantage the country.

Japanese market recoups losses

Amid a softening of US tariff threats, the Nikkei index (.N225) climbed 1.4% on Friday, fully recouping earlier losses. This marks a turnaround from the steep sell-off triggered by Trump's early April announcement of the most aggressive US import tariffs in a century. Most of these tariffs have since been put on hold, except for those imposed on China and the baseline 10% tariff.

Tech giants lead Japan's gains

Shares in Japan's technology sector led the rebound: electric motor maker Nidec (6954.T) soared 11% after forecasting record annual profit. Carmaker Nissan (7201.T) also rose 2% as investors expressed cautious optimism, even in the face of the company's projected record net loss.

Optimism sweeps Asian markets

Asian stock exchanges broadly ended the week on a high note. Hong Kong's Hang Seng Index (.HSI) gained 0.9%, while key Chinese indices, the Shanghai Composite (.SSEC) and CSI300 (.CSI300), also posted modest but steady increases, supporting an overall trend of rising sentiment among the region's investors.

USD strengthens, but caution lingers

The US dollar index ended the week up 0.4%, closing at 99.619. Despite the local strengthening of the American currency, investors remain wary, assuming that this period of relative stability could be short-lived.

Holiday pause in Australia and New Zealand

Stock markets in Australia and New Zealand were closed on Friday for national holidays, dampening overall activity across Asian trading floors. Yet even in these subdued volumes, analysts pointed to numerous signs that volatility could return in the near future.

Gold signals investor anxiety

Gold prices remain elevated, hovering around $3,349 per ounce. Analysts at Philip Securities in Singapore note that the Gold/S&P 500 ratio, a traditional barometer of investor anxiety, has climbed to its highest level since the pandemic-driven crash of 2020. This points to growing unease among market participants.

Treasuries remain under pressure

The US Treasury market continues to feel the strain. A broad sell-off in government bonds has deepened amid Donald Trump's tariff rhetoric, shaking investor confidence in US assets. The yield on the 10-year Treasury stood at 4.3168% on Friday, reflecting a general mood of caution and risk aversion.