Analysis of Trades and Trading Tips for the Euro

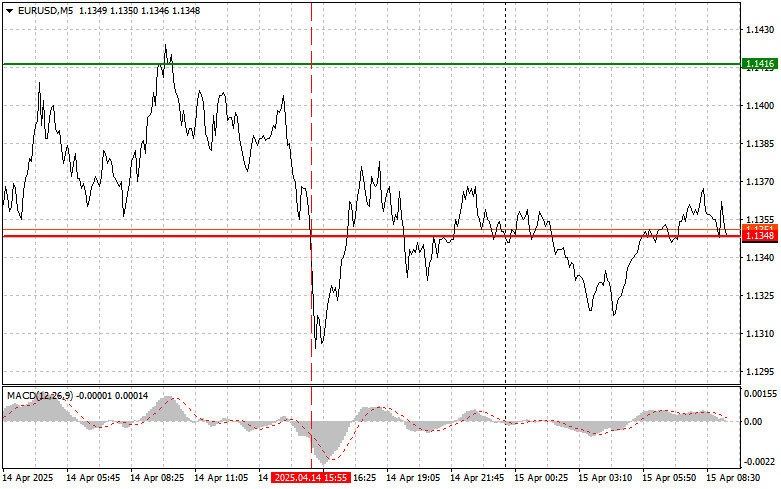

The price test at 1.1348 occurred when the MACD indicator moved significantly below the zero line, limiting the pair's downward potential. For this reason, I did not sell the pair and didn't see any other viable entry points.

The optimism by Federal Reserve representatives yesterday strengthened the dollar's position, but the fundamental factors driving EUR/USD remain unchanged. Technically, the pair retains potential for further growth, primarily due to macroeconomic indicators from the eurozone. Today, significant economic data from Europe is expected to be brought in. Investors will closely monitor the publication of sentiment indexes from the ZEW Institute for the business environment in Germany and the eurozone. These indicators reflect business expectations regarding future economic activity and can significantly influence the euro's performance. Positive readings exceeding forecasts would signal euro strength, while disappointing data could trigger a correction.

In addition to business sentiment, the ZEW Current Conditions Index will also play an important role. This indicator, which reflects the current state of the economy, will complement the overall picture and help better assess the eurozone's outlook. If the actual data beats expectations, EUR/USD will likely gain an additional upward impulse. Otherwise, the risk of a correction will increase significantly.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the euro today upon reaching the entry point around 1.1380 (green line on the chart) with a target of 1.1455. At 1.1455, I plan to exit the market and open a short position in the opposite direction, aiming for a 30–35 pip pullback. The expectation is for euro growth in the first half of the day as the uptrend continues after strong data.

Important! Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1336 level while the MACD is in the oversold area. This would limit the pair's downside potential and could trigger a reversal to the upside—expected targets: 1.1380 and 1.1455.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.1336 level (red line on the chart). The target is 1.1259, where I plan to exit the market and immediately open a long position in the opposite direction, aiming for a 20–25 pip rebound. If today's reports disappoint, downward pressure on the pair could return.

Important! Before selling, ensure the MACD is below the zero line and just beginning to move down from it.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1380 level while the MACD is in the overbought zone. This would limit the pair's upward potential and could trigger a downward reversal—expected targets: 1.1336 and 1.1259.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.