Analysis of Trades and Trading Tips for the Euro

The levels I had marked were not tested in the second half of the day. This was due to the market holiday and the closure of several major exchanges.

During today's Asian session, the US dollar saw a noticeable decline, directly linked to rumors about the possible removal of Jerome Powell from his post as Chair of the Federal Reserve. It is reported that US President Donald Trump is actively seeking his dismissal. These reports triggered turmoil in the currency markets, as a forced resignation of Powell—especially under pressure from the President—would cast doubt on the independence of the Fed. Investors are concerned that political interference in monetary policy could lead to short-sighted decisions aimed at quick gains at the expense of long-term economic stability. Recent criticism from Trump toward Powell for not cutting interest rates—which the President believes is holding back economic growth—has fueled these rumors. The dollar's decline is also driven by ongoing uncertainty surrounding the future of US trade policy. Prolonged trade negotiations with China and the threat of new tariffs continue to weigh on the greenback. Investors are turning to safer currencies, such as the Japanese yen and Swiss franc, weakening the dollar's position.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Signal

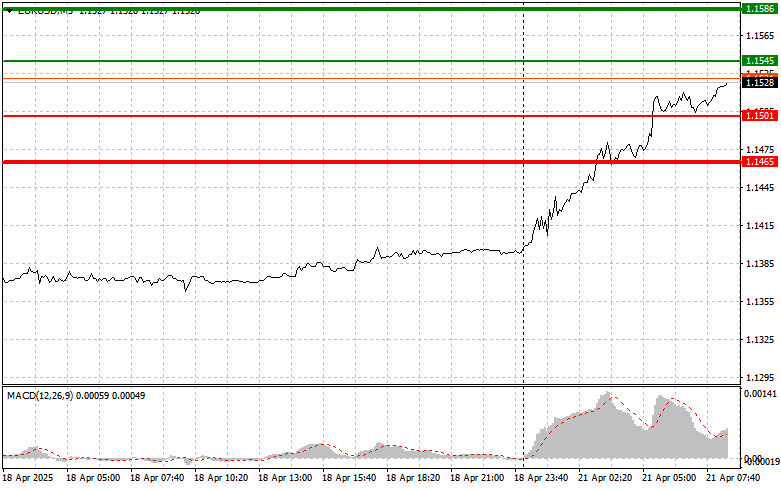

Scenario #1: I plan to buy the euro today at the entry point around 1.1545 (green line on the chart), with the target at 1.1586. I plan to exit the market at 1.1586 and open a sell position in the opposite direction, aiming for a 30–35 pip reversal. This setup assumes continued upward momentum in the first half of the day.

Important! Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1501 price level when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward reversal. A rise toward the opposite levels, 1.1545 and 1.1586, can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1501 level (red line on the chart). The target will be 1.1465, at which point I will exit the market and open a buy position in the opposite direction (expecting a 20–25 pip bounce from that level). However, downward pressure on the pair is unlikely to return today.

Important! Before selling, make sure the MACD indicator is below the zero line and starting to decline.

Scenario #2: I also plan to sell the euro today if the 1.1545 level is tested twice in a row while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a downward reversal. A drop toward the opposite levels, 1.1501 and 1.1465, can then be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.