Analysis of Trades and Trading Tips for the Euro

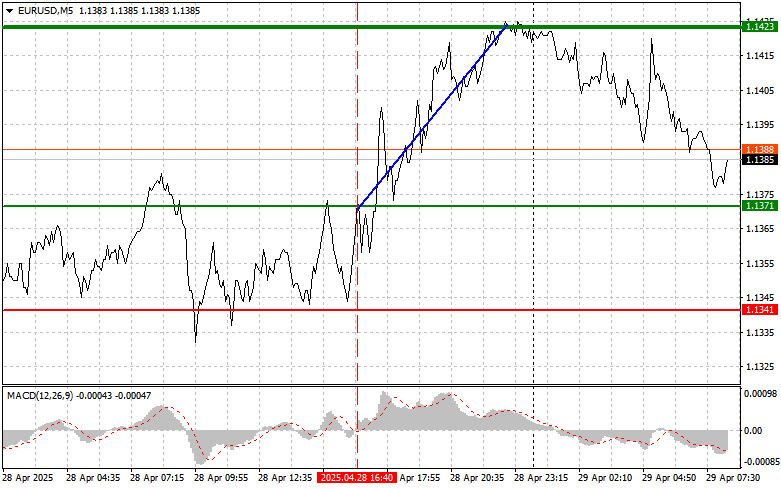

The test of the 1.1371 price level in the second half of the day coincided with the MACD indicator just beginning to move upward from the zero line, confirming a correct entry point for buying the euro and resulting in the pair's rise toward the target level of 1.1423.

Without significant fundamental data, geopolitics now plays a crucial role, and positive progress toward resolving the conflict in Ukraine will continue to support demand for risk assets. Investors, fatigued by uncertainty and concerned about a recession in developed economies, are again willing to invest in riskier assets. Additionally, we must not forget about geopolitical risks such as tensions between the U.S. and China, the situation in Taiwan, and other regional conflicts. Any of these factors could trigger a sudden capital outflow from risk assets and lead to fresh turmoil in financial markets.

Today is rich in economic reports: data will be released on Germany's consumer sentiment index, private sector lending volumes in the Eurozone, and changes in the M3 money supply. These indicators play a significant role in assessing the Eurozone's current economic situation and determining its future outlook. Germany's consumer confidence index traditionally serves as a barometer of consumer sentiment and, consequently, potential consumer spending. An increase in private sector lending in the Eurozone could signal rising investment activity and consumer demand, positively impacting economic growth. The dynamics of the M3 money supply are a key indicator of the European Central Bank's monetary policy. Growth in M3 may indicate increased liquidity in the economy, which could stimulate economic growth and heighten inflation risks.

If today's data surpass forecasts, it could further support the euro's growth observed earlier this week.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Signal

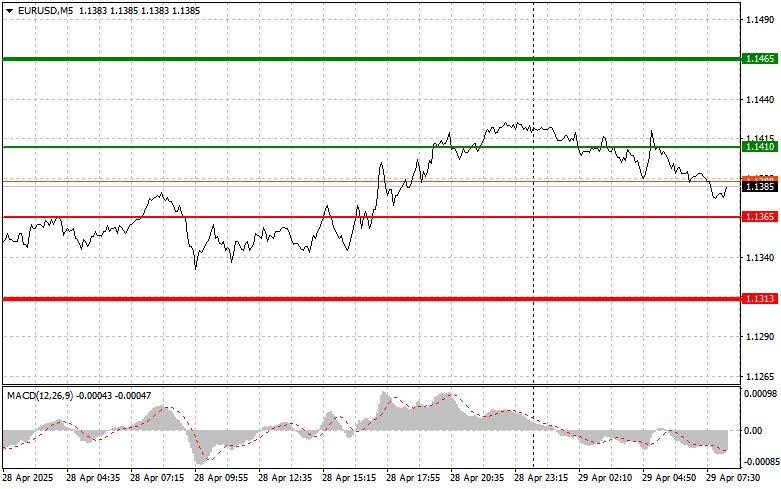

Scenario #1: Today, buying the euro is possible when the price reaches around 1.1410 (green line on the chart), with a target of rising toward 1.1465. I plan to exit the market at 1.1465 and also open a short position for a movement of 30–35 pips from the entry point. Expecting euro growth in the first half of the day is only reasonable if the data are favorable.

Important! Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1365 price level while the MACD indicator is in the oversold zone. This would limit the pair's downside potential and lead to a market reversal upward. A rise toward the opposite levels of 1.1410 and 1.1465 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1365 level (red line on the chart). The target will be 1.1313, where I plan to exit the market and immediately buy in the opposite direction (expecting a 20–25 pip movement in the opposite direction from the level). Pressure on the pair could return at any moment today.

Important! Before selling, ensure the MACD indicator is below the zero line and starting to decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1410 price level while the MACD indicator is in the overbought zone. This would limit the pair's upside potential and lead to a downward market reversal. A decline toward the opposite levels of 1.1365 and 1.1313 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.